|

|

|

|

ENERGY TAX CREDIT INFO

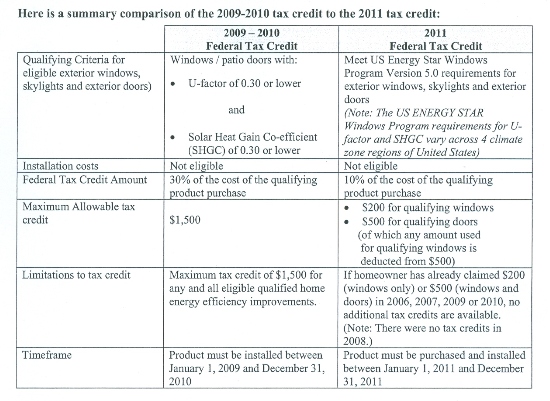

2011 Tax Credit Info.OVERVIEW Congress recently signed into law an extension of the 2010 tax credit for 2011. The extension includes significant changes around what products qualifies, the level of tax credits and establishment of lifetime credit caps. While typically less generous than the 2010 tax credit, the 2011 tax credit does offer some cost savings for your qualifying purchases. Summary 2011 tax credit 1.) The qualifying criteria for exterior windows, skylights, and exterior doors are the program requirements for the US ENERGY STAR Windows Program 5.0 2.) Tax credit is for the cost of the product only - the credit does not include installation costs. 3.) Tax credit is 10% of the amount paid up to the maximum amounts. 4.) The tax credit maximum is $500.00 total for any and all improvements. 5.) $1500.00 is maximum LIFETIME credit. If you have already received credit in the past this limits what you are eligible for in 2011. A homeowner who has already used up the $200 or $500 credit from 2006/2007 or the $1500 credit from 2009/2010 is NOT eligible for this 2011 tax credit. Beckerle Lumber offers you a wide range of windows and doors that help increase a home's comfort and energy efficiency. And, if you buy them now, you may qualify for a credit of 10% of the product cost up to $500 on your federal income tax. One of the most important features of this Energy Tax Credit is that the products must have a U-Factor and Solar Heat Gain Co-efficient of 0.30 or less. Not all products will qualify, so make sure you confirm before ordering. Click on the links below for more information on qualifying products. Supplier INFO links

For more information on Tax Credits for Home Builders, visit EnergyStar.gov. What is the difference between a tax credit and a tax deduction?

For more information on qualifying products, visit EnergyStar.gov Beckerle lumber a family tradition since 1940. |

| |